Residence Tax In Japan For Foreigners: An Easy 2026 Guide

As a foreigner living in Japan, you're legally required to pay residence tax (住民 税 = jumin zei).

However, filling in and filing tax documents can be daunting, especially if you're not sure where to begin.

Here are the key facts at a glance:

Category |

Details |

Notes |

What it is |

Local prefectural + municipal inhabitant tax |

Used to fund local services (schools, welfare, infrastructure) |

Who pays |

Anyone who lived in Japan on January 1 with taxable income in the prior year |

Residency status on Jan 1 controls liability |

Tax period |

Based on income from Jan 1 – Dec 31 of the previous year |

Always 1 year behind your income |

Tax rate |

10% of taxable income (6% municipal + 4% prefectural) |

Varies slightly by municipality |

Per-capita flat tax |

Approx. ¥5,000 (municipal/prefectural) + ¥1,000 Forest Environment Tax |

Municipalities may differ |

First year in Japan |

No residence tax |

Because no previous-year income in Japan |

Payments due |

June, Aug, Oct, Jan (or lump sum in June) |

Employees usually pay monthly via payroll |

Payment methods |

Special Collection (payroll) or Ordinary Collection (direct payment) |

Depends on employment status |

Official source |

Local Tax Act (地方税法) |

Tax rate: 10% of taxable income + ¥5,000 flat fee* (some variations exist)

Payment period: June, August, October, January (or lump sum in June)

Taxation period: Based on income from January 1 - December 31 of previous year

First year: No residence tax required

Assessment date: January 1st residency status determines liability

Payment methods: Salary deduction (employees) or direct payment (self-employed)

This article will explain the basics and the most important things to know about your residence tax in Japan as a foreigner.

Is residence tax in Japan different for foreigners?

No. Japan does not have a separate residence tax system for foreigners.

Foreign residents and Japanese nationals are taxed under the same law (the Local Tax Act / 地方税法). If you are living in Japan on January 1 and had taxable income during the previous year, you are required to pay residence tax—regardless of your nationality or visa type.

In other words:

-

Your residence tax is based on

your income from the previous calendar year, and

whether you were registered as a resident in a Japanese municipality on January 1.

Your status of residence (student, working holiday, engineer, dependent, permanent resident, etc.) does not change how residence tax is calculated.

For foreigners, the rules, tax rates, deductions, and payment methods are exactly the same as for Japanese residents.

What is residence tax in Japan?

Residence tax is a general term for the tax that residents of Japan must pay. Think of it as the local tax, which helps cover community-based public services such as education and welfare.

It funds:

public schools

welfare and social services

garbage and recycling programs

local infrastructure and administration

Residence tax consists of prefectural and municipal individual residence taxes, and taxpayers pay residence tax in both the municipality where they have filed a moving-in notification and the prefecture where that municipality is located.

Who needs to pay the residence tax?

Every resident in Japan must pay taxes. You must pay the residence tax if you reside in a Japanese prefecture and municipality as of January 1st.

You will not be taxed the year you arrive in Japan. However, you will be taxed for the previous year if you are still in Japan on January 1st of the following year. Even if you leave Japan before your bill arrives, you still have to pay it.

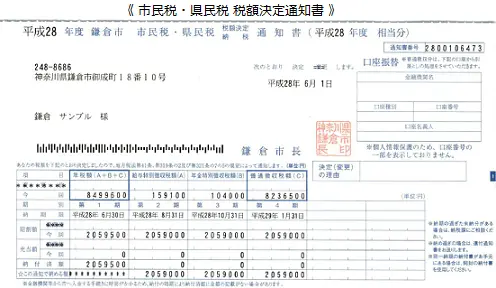

Image. Example of residence tax bill from Kamakura City, Japan

Timeline guide for new residents

Here's the timeline for residence tax if you've newly moved to Japan:

Year 1 (arrival year)

✅ No residence tax required

📝 File tax return if you earned income (optional for salary workers)

🏠 Register your address at city hall

Year 2 (second year)

💰 First residence tax bill arrives in June

📊 Tax based on Year 1 income (partial year)

📅 Set up payment method with employer or city office

Year 3 (third year onwards)

💰 Full annual tax calculation

📊 Tax based on full previous year's income

🔄 Regular annual cycle established

Residence tax for foreigners: common edge cases

Foreign residents often face the same questions when their situation changes. The following rules apply regardless of nationality.

If you leave Japan before your residence tax bill arrives

If you were registered as a resident in Japan on January 1, you are legally required to pay residence tax for that year—even if you leave Japan before the tax notice is issued in June.

Your residence tax liability is fixed based on your residency status as of January 1.

If you arrive in Japan after January 1

If you move to Japan after January 1, you will not be charged residence tax for that year. Your first residence tax bill will be issued the following year, based on the income you earn during your first year in Japan.

Does your visa type affect residence tax?

No.

Your visa or status of residence (student, working holiday, engineer / humanities, dependent, permanent resident, etc.) does not affect whether you must pay residence tax.

Residence tax is determined only by:

your taxable income in the previous year, and

whether you were registered as a resident in a Japanese municipality on January 1.

What if your income is very low?

You may be exempt from residence tax if your income is below your municipality’s non-taxable income threshold (非課税限度額).

These thresholds vary slightly by municipality and depend on:

your household situation, and

whether you have dependents.

This means that even if you lived in Japan on January 1, you may not receive a residence tax bill if your taxable income is below the local exemption level.

How is the residence tax calculated?

The tax is calculated based on your taxable income earned between January 1st and December 31st of the previous year.

The tax office examines your tax return (kakutei shinkoku) for this period and calculates the tax amount based on your per capita and income-based portions.

Residence tax structure

Residence tax (住民税) is a local tax, and it is different from Japan’s national income tax (所得税).

Residence tax consists of two parts:

Income-based portion (所得割 / shotoku-wari)

Per-capita portion (均等割 / kintō-wari)

Breakdown of residence tax

Component |

Rate / Amount |

Notes |

Prefectural residence tax – income-based portion |

4% |

Based on your previous year’s taxable income |

Municipal residence tax – income-based portion |

6% |

Based on your previous year’s taxable income |

Total income-based residence tax |

10% |

4% prefectural + 6% municipal |

Per-capita portion (prefectural + municipal) |

Approximately ¥5,000 |

Fixed amount set by each municipality |

Forest Environment Tax |

¥1,000 |

Nationally introduced surcharge |

How to calculate residence tax in Japan

The basic calculation is:

Taxable income × 10% = income-based residence tax

Then:

Income-based residence tax + per-capita portion = total residence tax

Important clarification:

The 10% rate shown above refers to the income-based portion of residence tax (所得割).

It is not Japan’s national income tax (所得税).

National income tax and residence tax are calculated separately and are paid to different authorities.

Residence tax examples for salaried individuals, ALTs, and self-employed individuals

Example |

Step |

Item |

Amount |

|

1: Office Worker (Salary ¥4,000,000/year) |

Step 1: Annual Income - Standard Deductions |

Annual Income |

¥4,000,000 |

Employment Income Deduction |

¥1,340,000 |

||

Basic Deduction |

¥430,000 |

||

Taxable Income |

¥2,230,000 |

||

Step 2: Calculate Tax |

Income-based Tax (10%) |

¥223,000 |

|

Per Capita Burden |

¥5,000 |

||

Total Annual Residence Tax |

¥228,000 |

||

Monthly Deduction from Salary |

¥19,000 |

||

|

2: English Teacher (ALT) (Salary ¥3,200,000/year) |

Step 1: Calculate Taxable Income |

Annual Income |

¥3,200,000 |

Employment Income Deduction |

¥1,080,000 |

||

Basic Deduction |

¥430,000 |

||

Taxable Income |

¥1,690,000 |

||

Step 2: Calculate Tax |

Income-based Tax (10%) |

¥169,000 |

|

Per Capita Burden |

¥5,000 |

||

Total Annual Residence Tax |

¥174,000 |

||

Monthly Deduction from Salary |

¥14,500 |

||

|

3: Freelancer (Annual Income ¥2,500,000) |

Step 1: Calculate Taxable Income |

Annual Income |

¥2,500,000 |

Business Expenses |

¥300,000 |

||

Basic Deduction |

¥430,000 |

||

Taxable Income |

¥1,770,000 |

||

Step 2: Calculate Tax |

Income-based Tax (10%) |

¥177,000 |

|

Per Capita Burden |

¥5,000 |

||

Total Annual Residence Tax |

¥182,000 |

||

Payment |

4 installments of ¥45,500 |

When are residence taxes due in Japan?

There are two types of payment methods for the residence tax with differing due dates.

If you choose a lump sum payment, you need to make the payment in June.

However, if you want to make an installment payment, you can pay it four times in June, August, October, and January.

How to pay Japan's residence tax

There are two methods for paying residence tax in Japan.

1. The special collection method

Translation from MIC Ministry of Internal Affairs and Communications

Employees are normally eligible for the "special collection" payment, also known as the "salary deductions" method.

This collection type involves the municipality sending your employer or company the tax notice and paying it on the employee's behalf.

As an employee, the resident tax will be deducted from your salary in one payment or smaller deductions throughout the year.

How it works:

City office sends tax notice to your employer in May

Total annual tax divided by 12 months

Deductions start in June and continue through May next year

Amount appears on your salary slip as "住民税" (jumin-zei)

advantages:

✅ Automatic payments - no risk of forgetting

✅ Spread over 12 months for easier budgeting

✅ No need to visit payment centers

What to expect:

First deduction appears in June salary

Same amount deducted each month

Employer handles all paperwork

2. The ordinary collection method

Translation from MIC Ministry of Internal Affairs and Communications

If you are a freelancer, self-employed, or currently unemployed, you must pay residency tax, depending on your previous year's annual income.

In June, the city office will send you a notice (tax payment slip) asking you to pay your residence tax if you earned any income in the previous year.

You can pay the taxes at the post office, a financial institution, or a convenience store for direct payment.

Payment options:

Lump Sum: Pay full amount in June

Quarterly: 4 payments (June, August, October, January)

Where to pay:

🏪 Convenience stores (Seven-Eleven, Lawson, FamilyMart)

🏦 Banks and credit unions

🏤 Post offices

💻 Online banking (some municipalities)

📱 Smartphone payment apps (PayPay, LINE Pay - varies by city)

When do I have to pay my resident tax?

If you have started working in Japan or just moved here, you are not subject to residence tax because you do not meet the required income tax requirements.

If you work for a company in Japan, the tax amount will be deducted from your salary starting in June. As an employee, you do not have to do anything.

If you are self-employed, you will receive a tax notification with a due date for when the residence tax is due.

Two things to be aware of in paying residence tax

1. Make sure you know your due tax amount before leaving employment

If you pay the residence tax by "special collection" but then quit your job, the remaining amount is paid through the ordinary collection.

However, some employers deduct the outstanding amount from your last salary or severance money. Hence, if you're thinking about resigning from your job, make sure what your action items are regarding tax payment.

2. Pay your tax before leaving Japan

If you're going to leave Japan, you'll still need to pay the due residence tax. If you cannot pay the taxes in advance before your departure, appoint a tax representative, like MailMate, who is authorized to pay your resident tax on your behalf with the local government office by submitting an authorization notice.

How can you reduce residence tax in Japan?

One way you can actively reduce your residence tax in Japan is through the Hometown Tax, which involves donating to the local government. The amount you donate is deducted from your income and residence taxes. You must file a tax return or use the One-Stop system for this reduction.

Here are some further tax planning strategies for Japan:

Category |

Strategy Area |

Details |

For Employees |

Maximize Deductions |

- Contribute to iDeCo (individual pension plan) - Make charitable donations - Keep medical expense records - Consider life insurance premiums |

Salary Negotiation Considerations |

- Understand how raises affect next year's residence tax - Factor residence tax into total compensation discussions - Plan for tax increases with income growth |

|

For Self-Employed Individuals |

Business Expense Optimization |

- Keep detailed records of all business expenses - Understand allowable deductions - Consider timing of income and expenses - Plan equipment purchases strategically |

Quarterly Payment Budgeting |

- Set aside 10–12% of income for residence tax - Use separate savings account for tax payments - Plan cash flow around payment due dates |

Can you apply for a tax deduction for Japan’s resident tax?

In Japan, you will need to pay income tax for all your income earned globally. Nevertheless, if you're already paying taxes for income in another country, that amount cannot be taxed again. Hence, you can apply for the already-paid tax to be deducted from your residence tax.

1. Foreign tax credit

You can deduct an amount from your Japanese income tax if you earned money from foreign wages or dividends and paid all the appropriate income taxes and individual resident taxes.

2. Tax conventions

Nearly every other country has signed a tax treaty with Japan, and some of them cover the residence tax. You can file an Application Form for Income Tax Convention (租税条約に関する届出書, sozei jōyaku ni kansuru todokede-sho) at a tax office or your local government office if you're a trainee, apprentice, or satisfy certain conditions, which could result in a lower or even waived residence tax. The notification must be submitted by March 15th.

You can find more information on residence tax on the Ministry of Internal Affairs and Communications Website.

Frequently asked questions

What is residence tax in Japan?

Residence tax is a general term used to describe the tax that residents staying in Japan need to pay.

Who needs to pay Japan's residence tax?

Every Japanese resident must pay taxes. You must pay the residence tax if you reside in a Japanese prefecture and municipality as of January 1st. The year you arrive in Japan, you will not be taxed. But you will be taxed for the previous year if you are still in Japan on January 1st of the following year. Even if you leave Japan before your bill arrives, you still have to pay it.

How is Japan's residence tax calculated?

The tax is calculated based on your taxable income earned between January 1st and December 31st of the previous year.

How much is the residence tax in Japan?

Residence tax for foreigners and Japanese nationals is based on the previous year's taxable income. The tax office will examine and calculate the tax amount and notify you if you are self-employed/unemployed or your company if you are employed.

When are residence taxes due in Japan?

If you choose a lump sum payment, you need to make the payment in June. However, if you want to make an installment payment, you can pay it four times in June, August, October, and January.

I'm a student working part-time. Do I need to pay residence tax?

If your annual income exceeds approximately ¥1 million, you'll likely need to pay residence tax the following year. Part-time income counts toward your total taxable income.

What happens if I forget to pay and leave Japan?

You remain legally obligated to pay. The city may contact your employer or bank, and unpaid taxes could affect future visa applications. Always appoint a tax representative if leaving with unpaid taxes.

Can I get a refund if I paid too much residence tax?

Yes, if you've overpaid due to calculation errors or didn't claim all eligible deductions. Contact your city tax office to file for a refund within the statute of limitations.

Do I pay residence tax in both my home country and Japan?

This depends on your home country's tax treaty with Japan. Many countries have agreements to prevent double taxation. Consult a tax professional familiar with international tax law.

How does marriage affect my residence tax?

Marriage itself doesn't change the tax rate, but you may become eligible for additional deductions if you have a dependent spouse. Each spouse files and pays residence tax individually based on their own income.

👉 You may also be interested in: Nozei Shomeisho: Your Guide to Japan's Tax Certificate.

👉 Go to our Japanese business glossary to learn more about the various tax types in Japan.

In closing

Now you know everything that comes with residence tax in Japan for foreigners and Japanese residents.

If you're leaving Japan, either temporarily or permanently, and need help paying your resident tax bill—try MailMate. MailMate is a bilingual service that includes bill pay, tax representation, and much more!

Spending too long figuring out your Japanese mail?

Virtual mail + translation services start at 3800 per month. 30-day money-back guarantee.