Your Ultimate Guide To PayPay Japan For Going Cashless

If you have a good eye, it’s likely you’ve seen the PayPay Japan logo when paying for items at the cash register.

Did you know that with the right app, you can scan that QR code and pay for items in Japan? So no more pulling out your cash or credit card because now you can pull out your phone to pay for things.

PayPay is the most famous cashless and QR code payment method in Japan (others include LinePay and AliPay).

If you want to try PayPay yourself, you’ve come to the right place. Here is your ultimate guide for PayPay Japan.

What is PayPay in Japan?

PayPay is a payment service app where you can make purchases on your phone via QR or barcode. It is widely used in Japan by restaurants, convenience stores, and retailers, and in some cases, you can even pay your bills using it.

Stores will accept PayPay and other similar services with this sticker

PayPay and similar services, such as LinePay and AliPay, connect to your bank accounts or credit/debit cards so that you can add funds to your PayPay wallet.

As a cashless payment option, there are over 55 million PayPay users, and it is one of Japan's most popular mobile wallets. So you will scan the PayPay Japan QR code and input the amount you owe.

PayPay can also automatically withdraw funds for any transactions made through the app. Think of it as your Apple or Google Wallet.

Comparison chart: PayPay vs other cashless options in Japan

Feature |

PayPay Japan |

Suica / Pasmo (IC Cards) |

Rakuten Pay |

Credit Cards (VISA/Mastercard) |

Availability |

Accepted at 4.5M+ stores, convenience stores, restaurants, taxis, utilities, online (Yahoo Japan, SoftBank) |

Trains, buses, convenience stores, many shops nationwide |

Online + offline (convenience stores, retail, restaurants) |

Almost everywhere in Japan (offline & online) |

Ease for Foreigners |

Requires Japanese phone + MyNumber/bank; tourists face hurdles |

Easiest option for tourists (buy at airport, load cash) |

Requires Japanese phone/account |

Easy if your card is enabled for international transactions |

Funding Options |

Japanese bank account, credit card, ATM deposit |

Cash, credit card (reloadable) |

Japanese bank account, Rakuten ecosystem |

Linked to your bank/issuer |

Cashback / Rewards |

0.5–1.5% regular; up to 20% during campaigns |

None (but JR points if linked) |

1% Rakuten Points (stackable with other Rakuten services) |

Varies (1–3% depending on issuer) |

App Language Support |

Basic English; advanced settings in Japanese |

Japanese, limited English on machines |

Mostly Japanese |

Depends on card issuer |

Best For |

Residents in Japan with Japanese bank info |

Tourists and short-term visitors |

Rakuten ecosystem users |

Travelers, expats, and anyone with a global card |

Key Limitations |

Tourists may not be able to register fully |

Cannot be used for online shopping |

Needs Rakuten ID & Japanese setup |

May not be accepted in smaller shops without card readers |

How to register for PayPay in English

We’ve broken down how to create a PayPay Japan account into simple steps from registration to setting up your account.

Step 1: Download the PayPay app

To get started, download* the PayPay app on the Apple Store or the Google Play Store.

You can also search "PayPayアプリ" to find it.

*Note: due to regional restrictions, the PayPay app might not be available to download in your country. You might need a Japanese account connected to the Apple or Google Play store or a Japanese phone to download the PayPay app.

Step 2: Sign-up for a PayPay account

How to sign-up with PayPay | PayPay

To get a PayPay Japan account, you’ll need to sign-up for one by registering your phone number and creating a password. If your phone is in English, then the app should display the basics in English as well. But if the app is displaying Japanese, click on “新規登録” to sign up.

After registering your phone, you’ll need to enter a confirmation code.

Now you have a PayPay account.

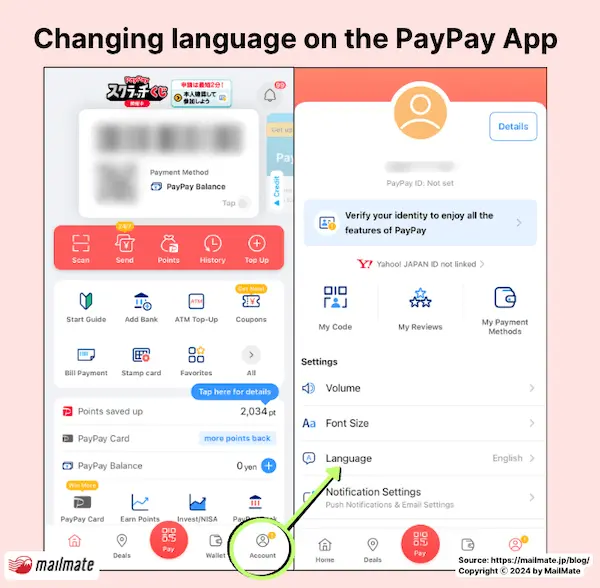

How to change the language on the PayPay Japan app for it to be in English

Step 3: How to add money to your PayPay account

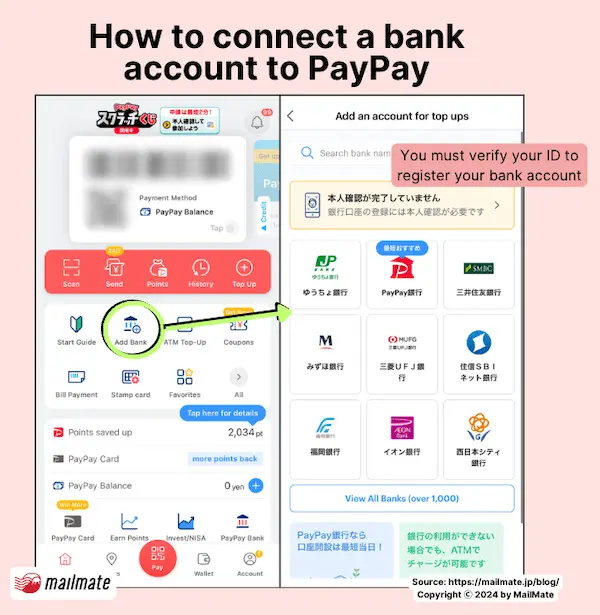

a. Connecting to your bank account to PayPay

You'll need to verify your identity first with a My Number Card or Driver's license and a real-time photo before connecting your bank account.

How to add a bank account to PayPay Japan

Select the bank account you would like to connect to and input the banking information, such as the branch name, your account number, and your account name.

You might also need to enter the PIN code or a one-time password as a final step.

b. Using cash as funds

You can input money into your PayPay account through ATMs at 7/11 or Lawson.

Even though it is in Japanese, this video demonstration has lots of visual clues or imagery that will show you how to insert money into your account.

How to input money into your PayPay Account through ATM at 7/11 | PayPayc. Adding your credit card

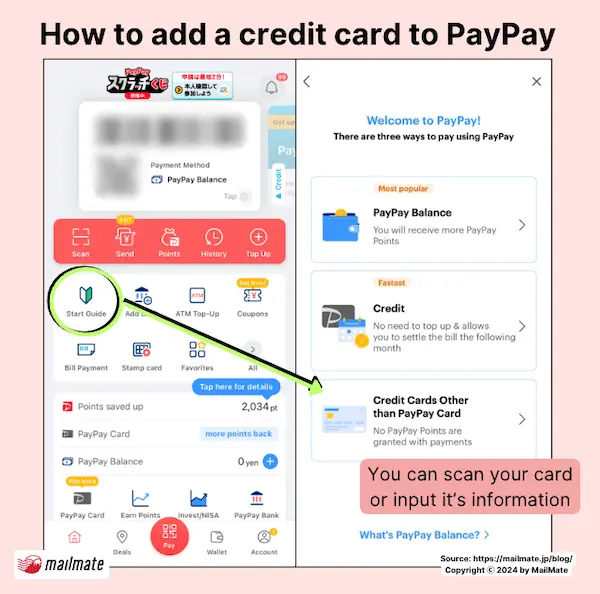

How to add a credit card to PayPay Japan

Let the app scan your credit card, or you can input the information yourself. Your credit card will then be connected to the app.

If you have a PayPay カード (PayPay credit or bank account), you'll get additional points every time a transaction occurs.

How do I use PayPay in Japan?

If you want to use PayPay in Japan, you’ll need to have an account with them.

There are two ways to pay with the PayPay app. But first, say, "PayPayでおねがいします (PayPay de onegaishimasu)" to the person at the register. If it is a self-checkout register, tap the QR code or PayPay payment option.

Then on your phone, tap on the bottom center button with “pay.”

PayPay barcode payment

Your PayPay barcode is the default option that will appear when you open the app. Have the store staff at the register scan that barcode to make your payment.

PayPay QR code payment

To pay via QR code, tap on “Scan & Pay” in the bottom right corner. Your phone screen will switch its camera mode.

Scan the QR code that is placed at the register, and enter the amount you need to pay. Show the clerk the screen and tap “Pay.”

Can foreigners use PayPay?

Yes, foreigners can sign up and use PayPay Japan. There are a couple of things to keep note of:

You will need a Japanese phone number or a phone number that can receive Japanese texts to register.

PayPay can only register VISA and Mastercard cards.

To verify your account, you may need a My Number card or Japanese Driver's license. Especially if you want to connect your a Japanese bank account.

Japanese bank accounts and credit cards work best with PayPay.

Even if you don't have a Japanese bank account or credit card for PayPay Japan, you can still add funds through ATMs in Japan.

What are the advantages and disadvantages of PayPay?

What is the advantage of PayPay?

One of the biggest advantages of PayPay is the convenience of making payments through your phone. With additional campaigns, discounts, and cashback incentives, people will use PayPay as a transaction method rather than pulling out their cash or card.

If you have a Yahoo ID, SoftBank account, or T-Card, you'll get more bonuses and points.

There are no fees to sign up or a minimum balance you need to maintain. Even if you don't have a Japanese bank or card, you can still insert money into your PayPay account through ATMs.

What are the disadvantages of PayPay?

One of the biggest struggles that foreigners can face with PayPay Japan is downloading the app. My American Apple account couldn't find or download the app, but my Japanese Apple account was able to.

Whether you are using your own data plan, pocket wifi, or free city internet, you'll also need a decent internet connection for payments to go through.

Additionally, while the app's basic function can be in English, more complex actions will be in Japanese.

Frequently asked questions

Is PayPay different from PayPal?

PayPay and PayPal are two different digital payment platforms. PayPay is a mobile payment service mainly used in Japan for cashless transactions by scanning a QR or barcode. PayPal is a global online payment service that allows money transfers and payments in different currencies.

Is PayPay a bank account?

PayPay Bank, or PayPay 銀行, started in 2021 and is an internet banking service for individual customers and businesses. Like any Japanese bank, they allow savings, loans, investment opportunities, sports lottery ticket purchases, foreign currency deposits, and overseas remittances all accessible through the PayPay Bank app.

How do you put money into PayPay Japan?

Once you have your account set up, there are three ways to add money to it. The first option is to link your account to your Japanese bank account. The second option is to add funds through a 7/11 or Lawson ATM. The third option is to add your credit card as a payment option.

How to withdraw money from PayPay Japan?

Within the PayPay app, tap the [Wallet] icon at the bottom. Then tap [Details] to the left of PayPay Balance. Then tap [Cashout] and tap the bank you want the amount transferred to. Add your bank account if needed. Write the amount you want to cash out. Please note that there is a 100 yen fee for non-PayPay Bank accounts.

Is there PayPay for foreigners?

Foreigners can use the PayPay Japan by registering and verifying your phone number on the app.

What is PayPay in Japan?

PayPay is Japan’s largest QR code mobile payment app, owned by SoftBank and Yahoo Japan. It allows users to pay at convenience stores, restaurants, taxis, and online simply by scanning a QR code. As of 2025, more than 60 million people in Japan use PayPay, making it the dominant cashless payment method in the country.

Can foreigners or tourists use PayPay in Japan?

Most foreigners living in Japan can use PayPay if they have a Japanese phone number, a MyNumber ID, and a local bank account. Tourists, however, generally cannot register because PayPay requires a Japan-based phone and identity verification. Visitors may find it easier to use alternatives such as Suica/Pasmo IC cards, Revolut, or simply a credit card.

Does PayPay have an English version?

Yes, PayPay offers a partial English interface for basic functions like payments and account setup. However, many menus, promotions, and customer support pages remain in Japanese. Tourists or short-term visitors may find the app usable for simple payments, but full navigation still requires some Japanese reading ability.

How do I top up (charge) my PayPay balance in Japan?

You can charge your PayPay balance in several ways: by linking a Japanese bank account, using a registered credit card, or depositing cash at a 7-Eleven or Lawson ATM. ATM top-ups are popular because you can insert cash directly, select “PayPay” on the screen, and scan your QR code to load money instantly into your balance.

Is PayPay safe to use?

PayPay is considered secure. The app uses encryption, biometric login, and real-time fraud monitoring. Since it is backed by SoftBank and Yahoo Japan, transactions are protected, and users can set daily spending limits. As with any digital wallet, the main risks are losing your phone or weak password practices, so enabling fingerprint/face login is recommended.

Can tourists in Japan use PayPay without a Japanese phone number or bank account?

In most cases, no. PayPay requires a Japanese phone number for registration and often a MyNumber card or driver’s license for verification. Tourists without these cannot fully use the service. Alternatives like Suica or Pasmo IC cards, or an international credit card, are much easier for visitors.

Where can you use PayPay in Japan?

PayPay is accepted at convenience stores (7-Eleven, FamilyMart, Lawson), chain restaurants (Sukiya, Yoshinoya, Gusto), taxis, drugstores, electronics retailers, and online services like Yahoo Shopping. It can also be used to pay some utility bills and municipal services.

How does PayPay compare to Suica, Rakuten Pay, Line Pay, or credit cards?

PayPay is the most widely used QR code payment system in Japan and offers cashback campaigns. Suica and Pasmo are better for tourists and transportation. Rakuten Pay works well for Rakuten ecosystem users. Credit cards are the most flexible option for international travelers but sometimes face acceptance issues in small shops.

What are the fees and limits for PayPay in Japan?

PayPay in Japan is mostly free to use, but there are a few fees and limits to be aware of. Adding money to your PayPay account through a linked bank, credit card, or convenience store ATM does not cost anything. Withdrawing funds to a PayPay Bank account is also free, while transfers to other Japanese banks carry a 100-yen fee per transaction. As for limits, users can usually spend or transfer up to 500,000 yen per day, though the exact amount depends on how fully your account has been verified with identification documents. These limits are designed to prevent fraud while still making the service convenient for everyday spending.

What promotions or cashback offers does PayPay have in 2025?

PayPay usually gives 0.5–1.5% cashback on everyday purchases. During seasonal or campaign periods, cashback can rise to 10–20% at partner stores. SoftBank and Yahoo Japan users often get additional exclusive campaigns.

In closing

PayPay Japan is one of the most popular cashless payment options in Japan and many people will just bring just their phones to pay for things. Even within the PayPay app, you can pay your bills, send and receive money, get insurance, and much more.

While setting up the app might take some effort at first, you’ll soon benefit from PayPay making your life convenient.

Spending too long figuring out your Japanese mail?

Virtual mail + translation services start at 3800 per month. 30-day money-back guarantee.