Easy Japan Consumption Tax Guide 2026

Quick answer: what is consumption tax in Japan?

Japan’s consumption tax (消費税) is a value-added tax applied to most goods and services consumed in Japan. The standard tax rate is 10%, with a reduced rate of 8% for certain items such as food and newspaper subscriptions. Although consumers ultimately bear the tax, businesses are responsible for collecting the tax and paying it to the National Tax Agency through periodic tax returns. Japan’s consumption tax uses an input tax credit system, similar to VAT systems in many other countries.

Who does Japan’s consumption tax apply to?

Japan’s consumption tax applies to both consumers and businesses, but their roles are different.

For consumers

Consumption tax is added to the price of most goods and services purchased in Japan. The customer ultimately bears the tax.

For businesses

Businesses are responsible for collecting consumption tax from customers and filing and paying the tax to the National Tax Agency.

Depending on their taxable sales, registration status under the invoice system, and transaction type, businesses may be required to file periodic consumption tax returns and make interim payments.

Whether you own a Kabushiki Kaisha / Godo Kaisha or a branch office of the parent company abroad, it is crucial to understand the requirements and regulations of tax in Japan.

This article focuses mainly on how consumption tax applies to businesses operating in Japan, including Japanese companies, sole proprietors, and foreign companies with a presence in Japan.

Japan's consumption tax system

First of all, we will explain how the consumption tax works in Japan.

Basic structure of consumption tax in Japan

Unlike income tax, which is based on profits, or excise tax, which targets specific goods, consumption tax is levied broadly on transactions such as the sales of goods and services.

Consumers bear the consumption tax, and businesses are responsible for collecting and paying it to the tax office.

A non-cumulative system (input tax credit system) is used to prevent double taxation through the production and distribution stages.

For some international services, such as digital services provided by foreign service providers, Japan may apply a reverse charge mechanism in which the recipient of the service is in charge of calculating and paying the consumption tax. This is relevant to business-to-business (B2B) transactions, but even for business-to-consumer (B2C) transactions, the foreign service providers may have to register for consumption tax purposes.

Source: National tax agency official website | 消費税のしくみ

Scope of taxation

Whether or not the company needs to pay consumption tax depends on the business purposes.

For consumption tax, the taxable transactions include the following items:

Sales of goods

Provision of services

Transportation of goods

Advertisement of goods

Leasing assets in Japan

Transfer of assets in Japan

Import goods from abroad

Non-taxable transactions include the following items:

Transfer or lease of land (excluding temporary leases)

Transfer of securities and payment instruments

Interest, guarantee fees, and insurance premiums

Sale of postage stamps and revenue stamps conducted at designated locations

Transfer of gift certificates and prepaid cards

Administrative fees, such as for residence certificates or family registry extracts

Foreign exchange transactions

Social health insurance medical care services

Long-term care insurance services and social welfare services

Childbirth-related expenses

Burial and cremation fees

Sale or lease of certain goods for persons with physical disabilities

Tuition fees, admission fees, entrance examination fees, and facility usage fees at designated schools

Sale of officially approved school textbooks

Lease of residential properties (excluding temporary leases)

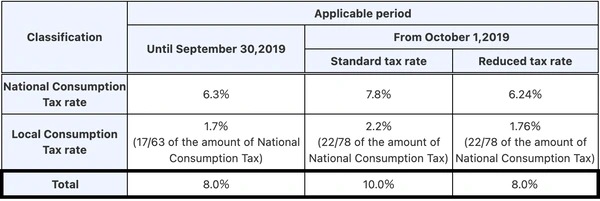

Current consumption tax rates

The current standard consumption tax in Japan in 2025 is 10%.

However, it is 8% (tax deduction) for specific items.

Standard tax rate: 10% (7.8% national consumption tax rate + 2.2% local consumption tax rate).

-

Reduced tax rate: 8% (6.24% national consumption tax rate + 1.76% local consumption tax rate)for:

Food and beverages such as take-out and delivery (excluding alcoholic drinks and dining out).

Newspapers published twice or more per week under subscription contracts.

Source: National Tax Agency Official Website

Note: Export transactions, export-like transactions such as international communications & international transport, and certain services to non-residents are taxed at a zero rate. Import transactions are subject to consumption tax.

Who must pay the consumption tax (taxable businesses)

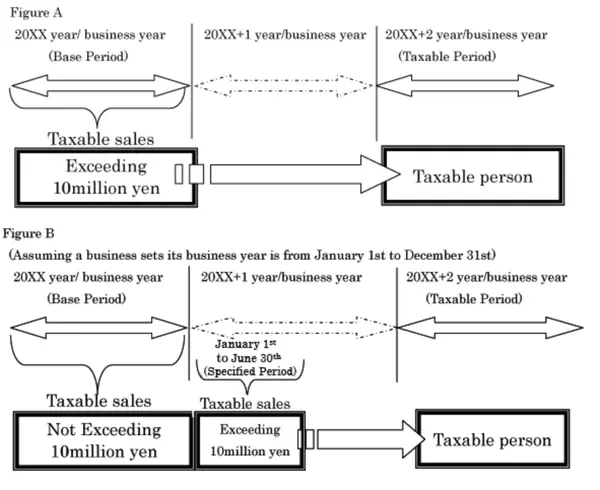

Businesses whose taxable sales exceed ¥10 million during the base period (the calendar year two years prior for sole proprietors, and the fiscal year two terms prior for corporations) are considered consumption tax payers (taxable businesses) for the applicable tax period (calendar year for sole proprietors, fiscal year for corporations).

Source: National Tax Agency Official Website

Even if the taxable sales in the base period are ¥10 million or less, if the taxable sales during the specified period exceed ¥10 million, the business will still be treated as a taxable business for that tax period.

Businesses with taxable sales of ¥10 million or less in both the base period and the specified period are considered tax-exempt enterprises and are exempt from consumption tax for that year (or fiscal year).

However, tax-exempt businesses can choose to become taxable businesses voluntarily.

If a business is registered as a qualified invoice issuer, it cannot be exempt from tax obligations, even if it meets the conditions for tax exemption.

Definition of the Specified Period:

For sole proprietors: January 1 to June 30 of the previous year.

For corporations: The 6-month period starting from the beginning of the previous fiscal year/business year.

Note: When assessing the ¥10 million threshold during the specified period, total payroll expenses (instead of taxable sales) may also be used for the calculation.

How the consumption tax is calculated

There are multiple ways to calculate consumption tax.

|

1) General method: (amount of consumption tax on taxable sales during the taxable period) - (amount of consumption tax on taxable purchases during the taxable period) = amount of consumption tax to pay |

|

2) Simplified method: Uses a deemed purchase ratio by business type. This system applies to businesses whose taxable sales for the base period are 50 million yen or less and who submit a notification form in advance. (consumption tax on taxable sales) - [(amount of consumption tax on taxable sales during the tax period) x (deemed purchase rate)] = amount of consumption tax to pay Deemed purchase rate Type 1 business (wholesale): 90% Type 2 business (retail): 80% Type 3 business (manufacturing, construction, etc.): 70% Type 4 business (others such as restaurants): 60% Type 5 business (service industry, transportation & communication, finance, insurance, etc.): 50% Type 6 business (real estate): 40% Note: If you operate two or more types of business, in principle, taxable sales are classified by type of business, and the amount of consumption tax on taxable sales for each business classification is multiplied by the deemed purchase rate. |

|

3) Special 20% Rule: The amount of consumption tax on taxable inputs is calculated by multiplying the amount of consumption tax on taxable sales during the tax period by 80%. (consumption tax amount on taxable sales) - (consumption tax amount on taxable sales x 80%) = amount of consumption tax to pay This special exemption can be applied for certain small businesses that have newly registered for invoices (Oct 2023 – Sept 2028) under the invoice system. However, the businesses with over ¥10 million taxable sales in the base period cannot apply this special exemption. |

Invoice system (from October 1st, 2023)

From October 1st, 2023, Japan implemented the “invoice system,” where only companies registered as qualified invoice issuers are qualified for consumption tax deduction on purchases.

In other words, if you want to receive a deduction for taxes on purchases, you will need to comply with the invoice system.

Although complying with the invoice system is not mandatory, there are great financial benefits.

How to register as a qualified invoice issuer

In order to register as a qualified invoice issuer, you must submit “Application for Registration as a Qualified Invoice Issuer” to the tax office director who has jurisdiction over your place of tax payment.

Once your application has been accepted, you will receive a "registration number” and will be able to issue qualified invoices.

Consumption tax filing and tax payment

-

Annual tax filing and payment

Sole Proprietors: By March 31st of the following year

Corporations: Within 2 months after the fiscal year ends

-

Interim filing and payment (required if prior year tax > ¥480,000)

¥480,000 ~ ¥4 million: once a year (half the amount of consumption tax for the previous tax period)

¥4 million ~ ¥48 million: 3 times a year (1/4 of the consumption tax amount for the previous tax period)

¥48 million ~: 11 times a year (1/12 of the consumption tax amount for the precious tax period)

Note: It is mandatory for non-resident businesses to appoint a tax representative to handle procedures related to tax.

Does the consumption tax paid by foreign corporations in Japan differ from Japanese companies?

Foreign companies operating in Japan (such as a branch office) must pay consumption tax on their domestic transactions just like Japanese companies.

Whether it is a branch office or subsidiary (such as Kabushiki Kaisha or Godo Kaisha) in Japan, they all become subject to the consumption tax if their taxable sales exceed ¥10 million during the base period.

Checklist: Is your company subject to consumption tax?

Here is a quick checklist for businesses to see if you need to pay the consumption tax.

1. Are You Doing Taxable Business in Japan?

|

Check if you are: Selling goods or services Importing goods Leasing or transferring assets in Japan |

Yes? → Go to 2. No? → Your company is not subject to consumption tax. |

2. Did your company make over ¥10 million in taxable sales?

a. Based on the Base period

(For sole proprietors: the calendar year two years ago; for corporations: in principle, the fiscal year two terms ago)

If taxable sales during the base period exceed ¥10 million |

Tax obligation applies |

If taxable sales during the base period are ¥10 million or less |

In principle, no tax obligation → Proceed to judgment based on the specified period |

b. Based on the specific period

(For corporations: the first 6 months from the beginning of the previous fiscal year; for sole proprietors: January to June of the previous year)

Taxable sales in the specified period |

Payroll expenses in the specified period |

Tax status |

Over ¥10 million |

Over ¥10 million |

Tax obligation applies (in principle) |

Over ¥10 million |

¥10 million or less |

Tax obligation applies, but you can choose tax-exempt status |

¥10 million or less |

Over ¥10 million |

Tax obligation applies, but you can choose tax-exempt status |

¥10 million or less |

¥10 million or less |

No tax obligation (in principle) |

3. Are You a Registered Invoice Issuer?

Even if your sales are under ¥10M, if you registered for invoice issuing, → You must pay consumption tax.

Checklist: Which calculation method should I use?

If you are a taxable business, follow this checklist to see which calculation method to use.

4. Are your taxable sales in the base period over ¥50 million?

If yes |

Use the general method (amount of consumption tax on taxable sales during the taxable period) - (amount of consumption tax on taxable purchases during the taxable period) = amount of consumption tax to pay |

If no |

Go to 5. |

5. Did you submit a notification for simplified taxation?

If yes |

Use the simplified method (consumption tax on taxable sales) - [(amount of consumption tax on taxable sales during the tax period) x (deemed purchase rate)] = amount of consumption tax to pay For the deemed purchase rate, see below. |

If no |

Go to 6. |

The deemed purchase rate used for the simplified calculation method.

Business type |

Rate |

Type 1: Wholesale |

90% |

Type 2: Retail |

80% |

Type 3: Manufacturing/Construction |

70% |

Type 4: Restaurants, etc |

60% |

Type 5: Services/Finance/Transport |

50% |

Type 6: Real Estate |

40% |

6. Are you a small business that registered as an invoice issuer between Oct 2023 and Sept 2028?

If yes, and your base period sales are ¥10 million or less |

You can use the Special 20% Rule |

If no |

Use the general method or the simplified method, depending on your business status |

Checklist: What is my filing and payment schedule?

Type |

Deadline |

Sole Proprietor |

March 31 (next year) |

Company |

2 months after the fiscal year end |

If you paid over ¥480,000 last year, you also need to make interim payments.

Amount |

Interim Number of Interim Filings |

¥480,000 ~ ¥4 million |

Once a year (half the amount of the consumption tax for the previous tax period) |

¥4 million ~ ¥48 million |

3 times a year (1/4 of the consumption tax amount for the previous tax period) |

¥48 million ~ |

11 times a year (1/12 of the consumption tax amount for the previous tax period) |

Step-by-step: How to file consumption tax in Japan

Consumption tax in Japan must be filed at the tax office by submitting the required documents. (If transactions during the taxable period are subject to a consumption tax rate of 10%, (including a reduced 8%)

Prepare the required documents

File by the deadline

You need the correct form depending on the taxation method. (General taxation method vs. Simplified taxation method)

You can get the forms at:

Final tax return preparation site

At your local tax office counter

Step 1: Prepare the required documents

The required documents depend on the taxation method. Here are the basic documents you will need.

Taxation method |

Required documents |

General method |

Consumption Tax and Local Consumption Tax Final Tax Return (General Version) Tax breakdown Form 1-3 : Consumption Tax Amount Calculation Table by Tax Rate / Table for Calculating the Consumption Tax Amount Used as the Tax Base for Local Consumption Tax Form 2-3 : Calculation Table for Taxable Sales Ratio and Deductible Input Tax Amount, etc. Detailed Statement for Consumption Tax Refund Return (in case of refund) Form 6 : Consumption Tax Amount Calculation Table by Tax Rate (for the 20% Special Exception) If you are filing interim tax return: |

Simplified method |

Consumption Tax and Local Consumption Tax Final Tax Return (Simplified Version) Tax breakdown Form 4-3 : Consumption Tax Amount Calculation Table by Tax Rate / Table for Calculating the Consumption Tax Amount Used as the Tax Base for Local Consumption Tax Form 5-3 : Calculation Table for Deductible Input Tax Amount, etc. Form 6 : Consumption Tax Amount Calculation Table by Tax Rate (for the 20% Special Exception) If you are filing interim tax return: |

Source: National Tax Agency Official Website

Step 2: File by the deadline

File your return either:

In person at your local tax office

By postal mail

Online via e-Tax

If the deadline falls on a weekend or public holiday, the next business day is the due date.

Professional assistance and resources

Since filing taxes can be challenging for foreign business owners in Japan, especially for those who do not speak Japanese, it is highly recommended to seek professional help for legal compliance.

Here are some bilingual professionals who can help you with complex tax filing in Japan.

For incorporation support in Japan, consider reaching out to MailMate.

With MailMate, you can launch a fully-compliant Japanese entity in as little as 14 days.

There is only one fixed fee, which includes incorporation address and Japanese mail handling.

MailMate also provides various supports for foreigners who want to start a business in Japan:

Tax representative

Domestic point of contact

Business address for company registration

Virtual mailbox in Japan

Japanese phone numbers

Bilingual receptionist service

Bill payment service

Bilingual assistant service… and more!

MailMate has been successfully helping foreigners start businesses in Japan!

Frequently asked questions about consumption tax Japan

Here are some of the frequently asked questions.

Q: Do tourists and foreigners pay consumption tax in Japan?

A: Yes. Anyone purchasing goods or services in Japan generally pays consumption tax. However, eligible visitors may receive tax-free treatment for certain purchases under Japan's tax-free shopping system.

Q: Is consumption tax included in the displayed price in Japan?

A: Prices may be shown either tax-inclusive or tax-exclusive depending on the store. Many retailers display tax-inclusive prices, but businesses are allowed to display tax-exclusive prices if clearly stated.

Q: Can consumption tax be refunded in Japan?

A: Only qualifying foreign visitors can receive refunds through designated tax-free shops. Residents and businesses cannot receive refunds for personal purchases.

Q: Is Japan's consumption tax the same as VAT?

A: Japan’s consumption tax operates in a similar way to VAT, using an input tax credit system, but it is governed by Japanese tax law and specific local rules such as the invoice system.

Q: Do I need to pay consumption tax in Japan as a business?

A: You will need to pay consumption tax if your business meets any of the following conditions:

Taxable sales exceed ¥10 million in the base period

Taxable sales exceed ¥10 million in the specified period

You registered as a qualified invoice issuer (even if sales are under ¥10 million)

Foreign companies operating in Japan (such as branch offices) follow the same rules as Japanese companies for taxation. The article explains in detail.

Q: How do I calculate and file consumption tax in Japan?

A: The calculation method depends on your business size and structure:

Over ¥50 million in base period sales: Use the general method (tax on sales minus tax on purchases)

Under ¥50 million: You can choose the simplified method using deemed purchase rates by business type (40%-90%) or the general method

Small businesses registered for invoices (Oct 2023-Sept 2028): Can use the Special 20% Rule

Filing deadline for individual business owners is March 31st of the following year, and for corporations, it is within 2 months after fiscal year end.

If your previous year's tax exceeded ¥480,000, you'll also need to make interim payments throughout the year. Detailed information explained in the article.

In closing

Understanding the tax rules and regulations is crucial for any business owner in Japan.

The key takeaways include the ¥10 million threshold that determines tax obligations, recognizing the difference between the standard 10% rate and the reduced 8% rate for specific items, and choosing the appropriate calculation method based on your business size and circumstances.

The tax filing timing, as well as the amount of the interim filing requirements, are also crucial to understand.

When you feel overwhelmed, use the consumption tax checklist in the article to see what you need to do for the consumption tax in Japan.

Also, if you need help with incorporation, virtual address, virtual P.O. box, tax representative, etc, check out MailMate’s website to see how we can help you!

Spending too long figuring out your Japanese mail?

Virtual mail + translation services start at 3800 per month. 30-day money-back guarantee.