Car Loan for Foreigners in Japan: Complete Guide

Those who live in cities in Japan can live comfortably without a car, thanks to the excellent public transportation. However, it’s a different story if you live in the suburbs or countryside.

Some foreign residents who do not hold Japanese citizenship may wonder if they can get a car loan in Japan.

It is technically possible for foreigners to take out a car loan in Japan, even without Japanese citizenship.

This article will show you the requirements, necessary documents, tips, and recommended loan companies for foreigners seeking a car loan in Japan.

Can foreigners get a car loan in Japan?

The answer is yes, but it’s not easy.

Most Japanese loan companies approve loan contracts regardless of nationality. So technically, it is possible for foreigners to get a car loan.

However, there are conditions and requirements to meet, and it can be difficult depending on your visa status and income.

Eligibility requirements for a car loan for foreigners in Japan

There are two key conditions for applicants to qualify for a car loan.

You must either have a Japanese permanent residency or a long-term visa

You must have a sufficient and stable income to be able to repay the loan amount

The more stable the above two factors are, the easier it will be to pass the loan screening. Financial institutions and loan companies will not approve a loan if they believe there is a risk of non-repayment. Therefore, minimizing risk factors as much as possible is key.

You must have a permanent residency or a long-term visa

One of the biggest risks for financial institutions and loan companies is the possibility of non-payment due to foreigners returning to their home country.

Because of this risk, it is not possible to take out a car loan with a short-term visa, such as a tourist visa.

Many loan companies prefer foreigners with permanent residency, but it is not completely impossible to get a car loan without it.

With a long-term visa, having lived in Japan for a long time and having renewed your visa multiple times will work in your favor.

When applying, it’s important to note that your visa has been recently renewed and is not nearing the end of its validity.

Without a permanent residency: strict credit checks, higher interest rate, and long repayment not allowed

There are three key points to note if you do not hold a permanent residence card and want to apply for a car loan in Japan:

1) Credit checks are strict

As mentioned earlier, the screening process includes stricter standards to avoid potential non-payment. Financial institutions or loan companies will likely ask for additional documents to support your long-term stay in Japan.

2) High interest rate

Even if you’re approved, they may impose a high interest rate due to risk factors. Some companies offer low-interest rates for foreigners if they have a Japanese guarantor. If you have a Japanese spouse, making them your guarantor may improve your chances of getting approved with a lower rate.

3) Long-term repayment periods are not possible

Most institutions set repayment periods within the length of your visa. Unless you have a long-term visa (e.g., 5 years), the repayment period will likely be short.

You must have a sufficient and stable income to be able to repay the loan amount

This requirement applies to any type of loan, but you must have a stable and sufficient income to successfully apply.

What is considered “sufficient” depends on the loan amount, so it’s best to contact the lender directly.

If you hold a work visa, having a stable position and income that allows for long-term residency in Japan will improve your chances.

Necessary documents for foreigners when applying for a car loan

The following documents are generally required:

Identification document (e.g., passport, driver's license, etc.)

Residence card (Zairyu card)

Proof of income (e.g,. income tax payment certificate, copy of tax return with tax office stamp, etc.)

Documents showing the price of the car to purchase (e.g., quotes, purchase orders, etc.)

If you have a Japanese guarantor, their ID and seal registration certificate will also be needed.

How to make it easier to pass the loan screening

Here are some tips to help you qualify, especially if you don’t have permanent residency:

Get a Japanese guarantor

Some lenders don’t require a guarantor, but having one significantly increases your chances. They must be a Japanese national aged 18–65 with a stable job and strong credit.

Have a Japanese address

Having a rental contract or owned property in Japan helps. Some companies may verify your address via resident registration.

Secure a stable income source

Full-time employment (正社員 / seishain) is preferable to contract work. If you’re not in such a role, securing a more stable position beforehand is recommended.

Choose to purchase a used car

A lower car price increases approval odds. In Japan, many used cars cost under 1 million yen, making them a smart, low-risk choice.

Obtain a permanent residency

If you’re close to qualifying for permanent residency (10+ years in Japan, 5+ years with work/residence status), consider waiting to apply until you have it.

Top auto loans for foreigners in Japan

Here are some reputable auto loan options.

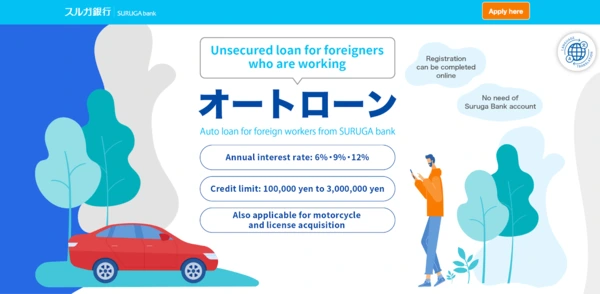

SURUGA bank

Interest rate: 6% ~ 12%

Usage limit: ¥100,000 ~ ¥3 million

Repayment period: up to 10 years

Guarantor: Not required

SOMPO Japan

Interest rate: 1.5% ~ 3.95%

Usage limit: ¥200,000 ~ ¥10 million

Repayment period: 6 months ~ 10 years

Guarantor: Not required

OTORON

OTORON is a used car dealership with a loan payment option.

Interest rate: 0%

Usage limit: depends

Repayment period: up to 3 years

Guarantor: Required

💡Do you need help in Japan? MailMate can help you!

If you live in Japan and are overwhelmed with all the important mail in Japanese, tax, incorporation, property management, or bill payments, MailMate is here to help you!

Cloud mail service with translation

MailMate receives, stores, and converts your mail to high-res PDFs

You can check your mail from anywhere in the world through the dashboard

You can easily share important mail with your team, lawyers, or accountants

Get English mail translation and summarization & interactive concierge

Liaison and bill-payment service

MailMate will deal with non-English speaking organizations & pay bills on your behalf

Receive and pay your tax and utility bills without a Japanese bank account

Local point of contact for utility set-up, ongoing bill payment, and more

Incorporation/business establishment help

With MailMate, you can launch a fully-compliant Japanese entity in as little as 14 days

MailMate provides a high-end virtual office address in Japan to register your company in Japan

You can launch a branch office with MailMate

MailMate has been helping foreign residents in Japan and consistently receives excellent feedback!

For car insurance, read also: Car Insurance in Japan: A Guide to the Top Providers

Frequently asked questions

Can a foreigner take out a car loan in Japan?

Yes, but it highly depends on your visa status and your income. It is easier to get approved if you have permanent residency or a long-term visa, along with stable income. Most Japanese loan companies approve contracts regardless of nationality, but foreigners face stricter requirements due to the perceived risk of non-repayment if they return to their home country. Those without permanent residency will face stricter credit checks, higher interest rates, and shorter repayment periods.

What are the documents required for a car loan application?

The generally required documents include:

Identification document (passport, driver's license, etc.)

Residence card (Zairyu card)

Proof of income (income tax payment certificate, copy of tax return with tax office stamp, etc.)

Documents showing the price of the car to purchase (quotes, purchase orders, etc.)

If you have a Japanese guarantor, you'll also need their identification document and seal registration document.

How can I raise the chance of getting a car loan without having a permanent residency?

Several strategies can improve your approval chances:

Get a Japanese guarantor: preferably a Japanese national aged 18-65 with stable employment and excellent credit

Have a Japanese address: maintain a rental contract or own property in Japan

Secure stable income: full-time employment (正社員 Seishain) is preferred over contract work

Choose to purchase a used car: lower-priced vehicles (under 1 million yen) increase approval odds

Consider obtaining permanent residency before applying if you're close to meeting the requirements (10+ years in Japan, 5+ years with work status)

What is the alternative option if I can't get a car loan?

Car leasing instead of purchasing (includes maintenance and insurance in the price)

Saving to buy a less expensive used car with cash

Finding specialized lenders that focus on foreign residents

Waiting to build more credit history in Japan before reapplying

In closing

Getting a car loan for foreigners in Japan takes preparation and patience, but it is possible. In order to do so, build a stable income, obtain a long-term visa or permanent residency, work on a good credit history, and practice careful repayment planning.

Start by researching lenders, preparing your documentation, and contacting institutions that speak English. With proper preparation, your car loan approval and Japanese driving adventure are within reach!

If you ever need help with your Japanese mail management, bill-pay service, incorporation, and property management, consider using MailMate!

Explore further:

Spending too long figuring out your Japanese mail?

Virtual mail + translation services start at 3800 per month. 30-day money-back guarantee.